This podcast synthesizes Simon Dixon’s ontological framework for understanding global power as a system directed by the Financial Industrial Complex, a network of commercial banks, Federal Reserve member institutions, and asset managers such as BlackRock, Vanguard, and State Street.

The discussion grounds Dixon’s position that global affairs move according to capital-allocation patterns resembling a unified portfolio, in which nations function as line items and political leaders serve as managers hired to protect asset flows. The conversation introduces Dixon’s background as an investment banker and early Bitcoin advocate who observed the structure of financial control from inside large institutions.

6:18 Explainer Video

The Architecture of Control

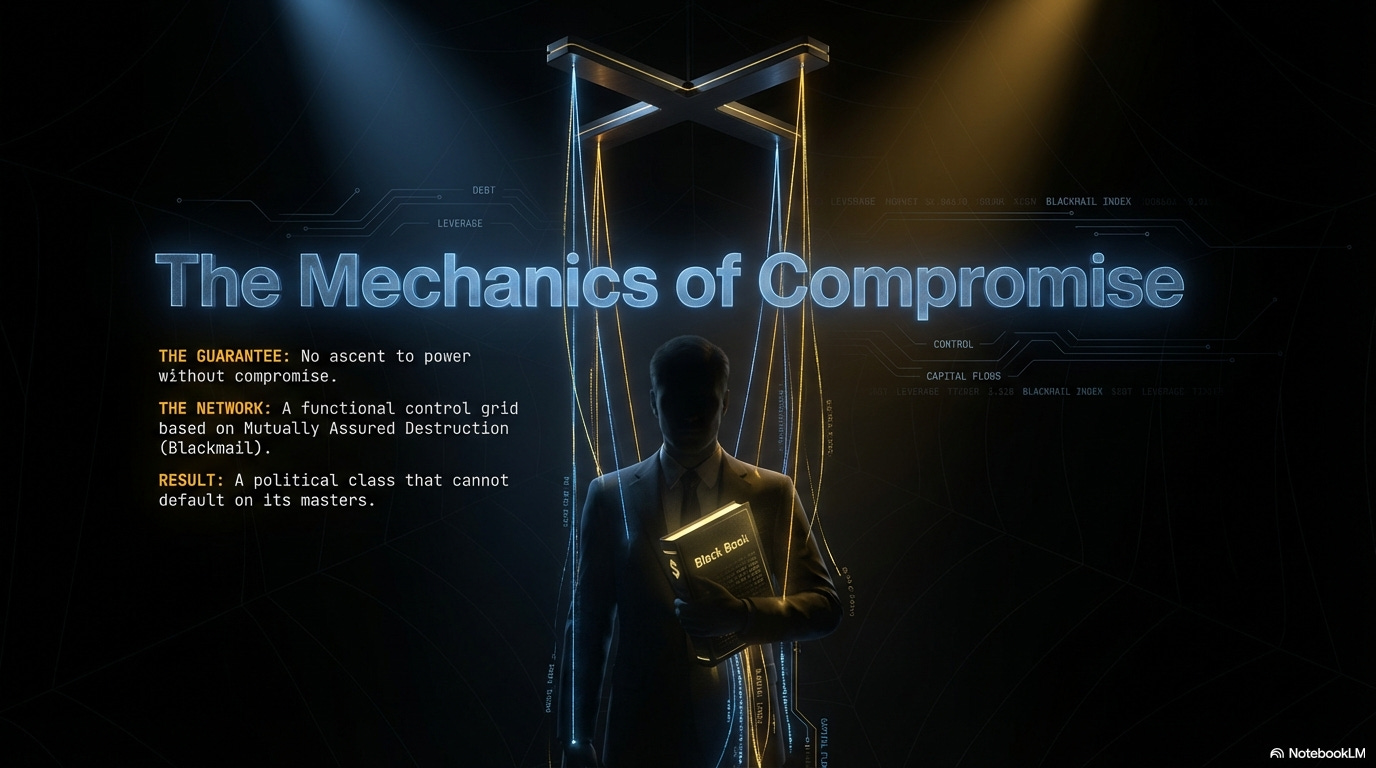

Dixon describes two mechanisms that secure the power of the Financial Industrial Complex. The first is the golden leash of capital access, which shapes the behavior of powerful individuals who hold wealth through stock positions.

Liquidity events require loans secured by those positions, which creates exposure to margin calls. Market actors who coordinate hedge fund pressure or derivatives activity can trigger those calls and force borrowers to comply, who face the loss of entire corporate stakes.

This leverage drives actions that align with FIC objectives. The second mechanism is political influence through lobbying, campaign finance, and mutual guarantee structures rooted in shared secrets and compromise.

Dixon points to the Epstein network as an operational method for maintaining continuity across political and corporate classes.

Competing Industrial Complexes

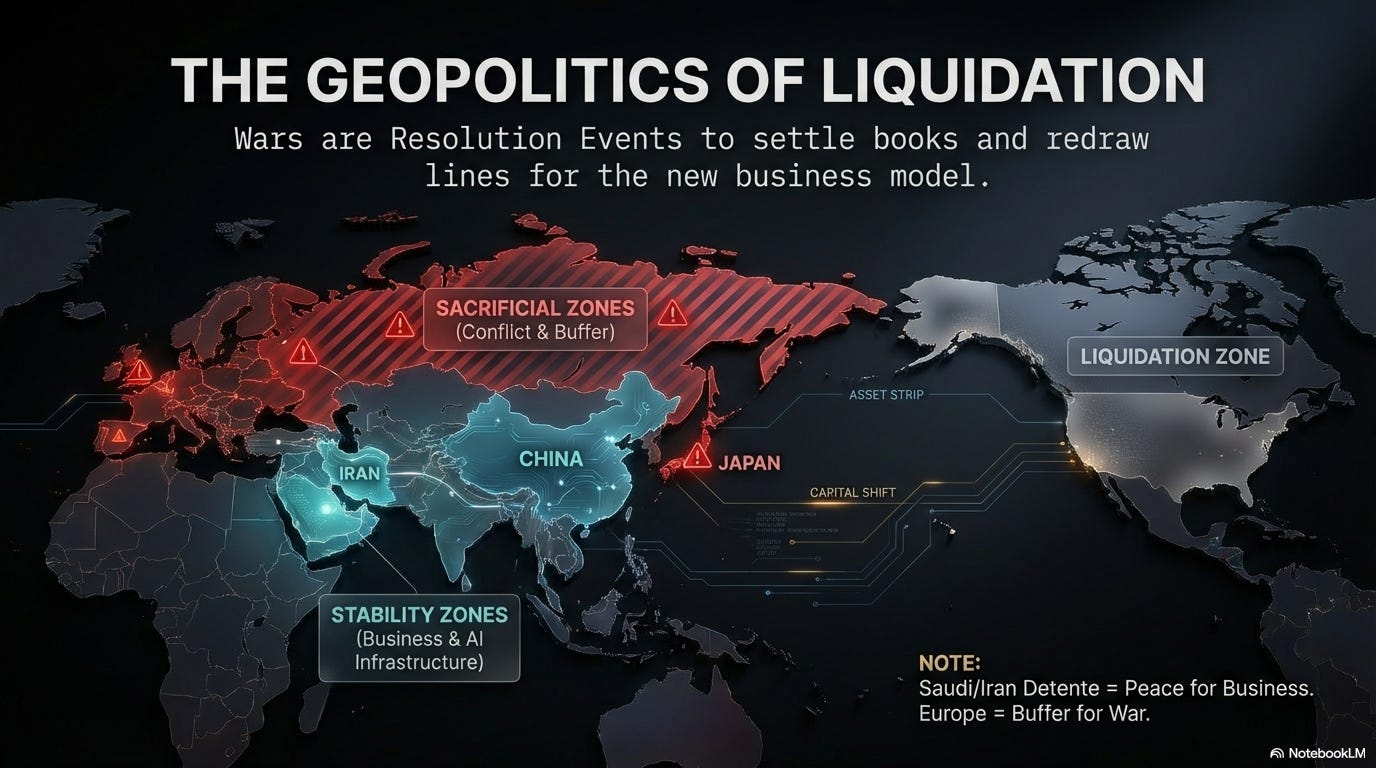

Dixon situates the Military-Industrial Complex beneath the Financial-Industrial Complex. The MIC historically shaped regional instability to reinforce dollar dominance, strengthen U.S. capital inflows, and open channels for IMF debt.

He explains that the current phase seeks calibrated instability that pressures regional actors into resource negotiations rather than long campaigns of kinetic warfare.

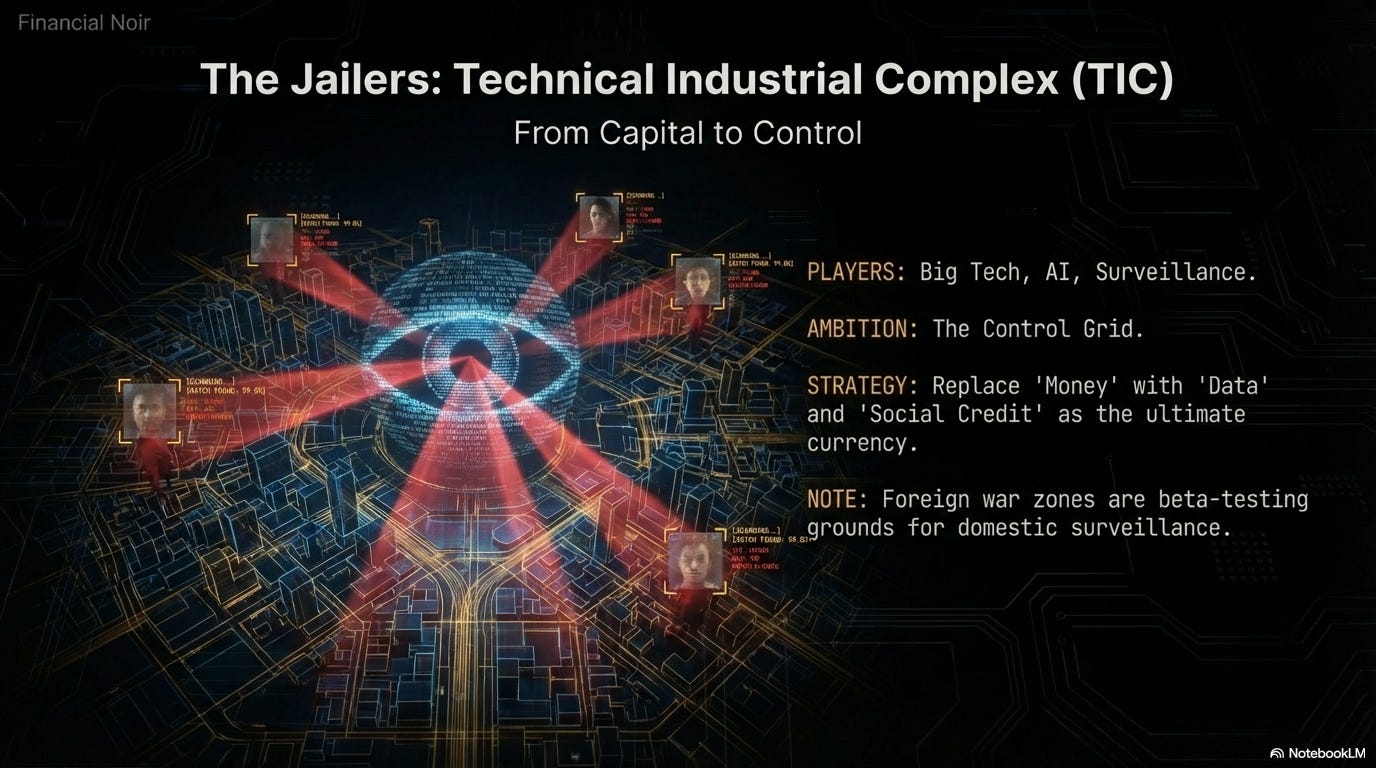

Dixon defines the Technical Industrial Complex as a rising system built around AI models, surveillance engines, digital identification frameworks, and programmable infrastructure. This system requires extraordinary capital access for data centers, robotics, and grid expansions, which places it under FIC direction in its present form.

The State as an Instrument of Capital

Dixon argues that governments function as tools for resource extraction, converting public debt into private profit. Bailouts, subsidies, and zero-interest mechanisms circulate government liabilities into corporate pipelines, enriching stakeholders aligned with the Financial Industrial Complex. Presidents and prime ministers operate within this structure as managers who coordinate spending and regulatory signals that match capital priorities. Dixon frames this structure as a closed-loop cycle between political authority and financial engineering.

Trump and Fiscal Consolidation

Dixon assigns a specific role to Donald Trump within this system. He argues that Trump directs public attention through a narrative centered on battling entrenched power while advancing a program that concentrates financial control within the Treasury. Dixon calls this fiscal dominance and explains that it merges political and financial functions inside a single command structure.

Debt Expansion and Manufactured Growth Signals

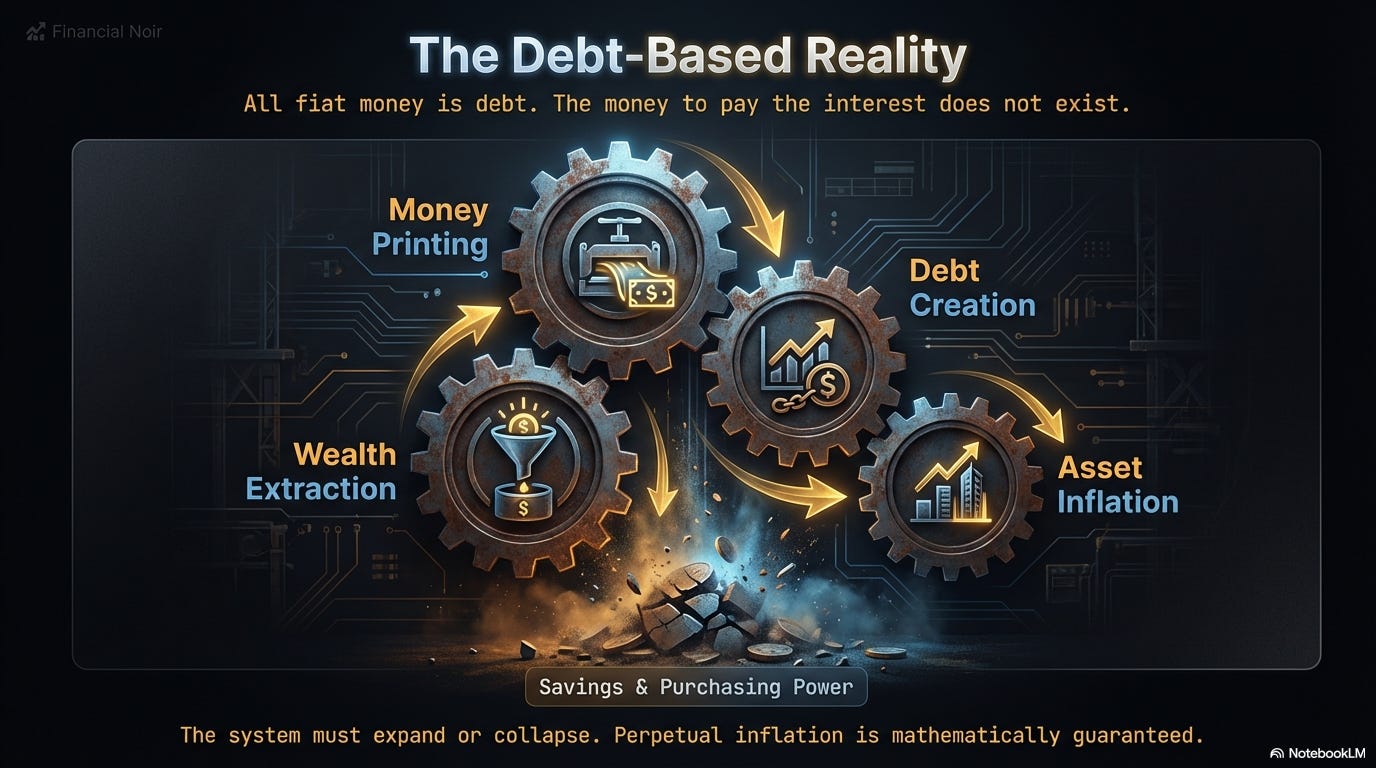

Dixon sets U.S. fiscal dynamics within a perpetual debt rollover system. Interest obligations exceed the money supply, which forces continuous borrowing to sustain the cycle. Government-backed AI and military contracts inject liquidity into public markets, creating strong growth signals that attract foreign capital. Those signals support the appearance of economic vitality while reinforcing the capital pipeline. Dixon ties these conditions to the K-shaped economy, which channels gains to asset holders and compresses outcomes for others.

Narrative Warfare and Algorithmic Sorting

Dixon describes a system of ideological redirection that channels public frustration into rigid identity conflicts. Algorithms accelerate this process by guiding users toward extreme narratives when they search for insight into financial corruption. Dixon identifies X as a honey trap that grants a space for expression while restricting distribution and compiling granular surveillance profiles for future leverage.

The Multipolar Asset Realignment

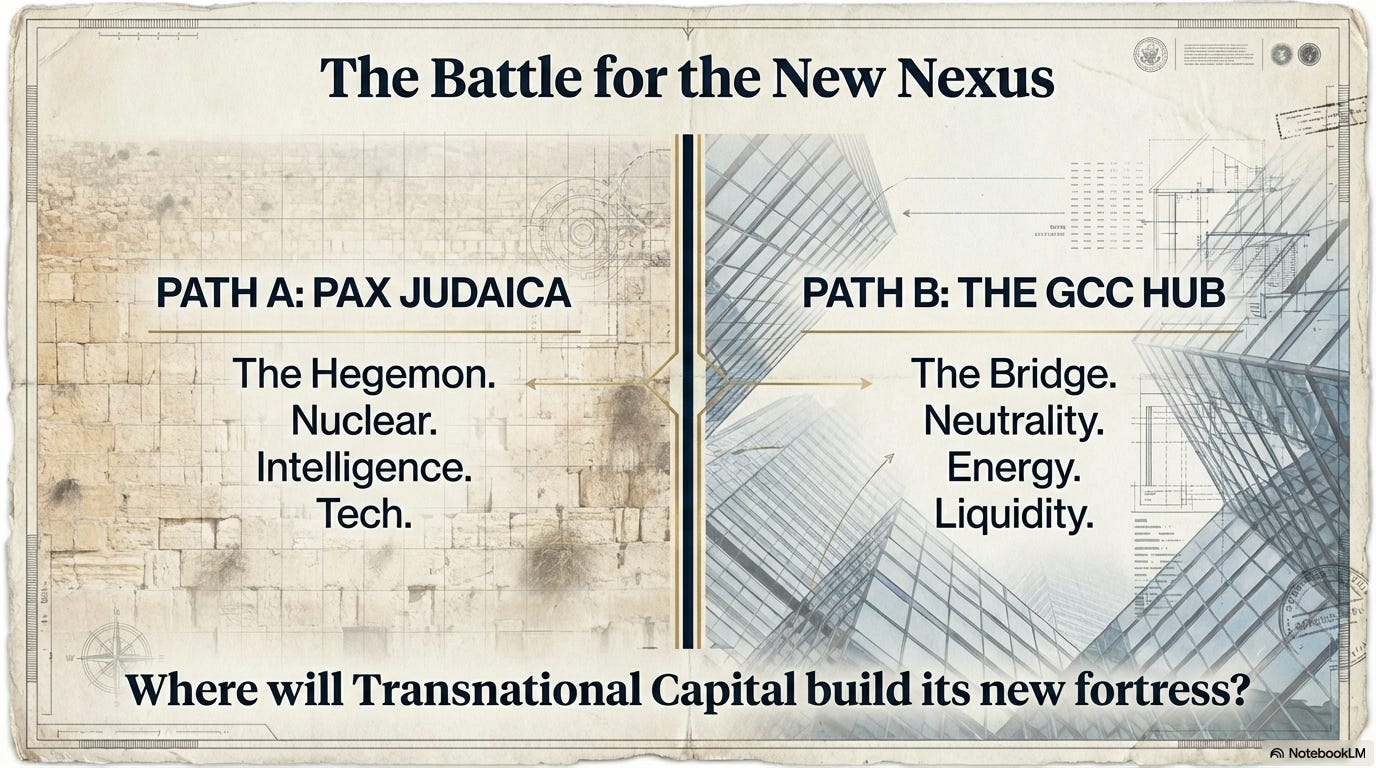

Dixon presents the decline of the U.S.-centered dollar system as a strategic asset migration. The Financial Industrial Complex pursues regional blocs that reduce military burdens and increase efficiency. The Western Hemisphere forms a unified resource zone for North and South America. China and Russia consolidate a Eurasian manufacturing and extraction region. Gulf sovereign wealth funds form the central financial hub that links Western capital to Eastern production capacity. Dixon cites megaprojects such as Neom as expressions of this partnership.

Conflict as a Mechanism for Asset Transfer

Dixon applies this model to the Ukraine war by identifying the outcome as the vassalization of Europe through the removal of cheap Russian energy. He traces the resulting manufacturing advantage to China and to Russia's consolidation within BRICS. He also identifies distressed Ukrainian assets, including agricultural land, as targets for acquisition by firms such as BlackRock once the conflict settles.

The Digital Control Grid

Dixon outlines a future built through programmable money, digital IDs, and UBI structures that regulate access, mobility, and transactions. He cites companies such as Palantir as contractors that channel intelligence and surveillance functions into private systems that operate outside traditional government frameworks. Programmable money allows instantaneous directional control of economic behavior without legislative intervention.

Bitcoin, Custodial Capture, and Synthetic Exposure

Dixon warns that custodial Bitcoin and exchange-traded products create fractional-reserve conditions that mirror traditional banking risks. ETF structures offer synthetic performance rather than direct one-to-one backing. Dixon also critiques Michael Saylor’s leveraged position, which places large Bitcoin holdings at risk of engineered liquidation events by lenders who hold the collateral pathways.

Exit Through Local Sovereignty

Dixon closes with a call for a financial boycott through self-custody, real assets, and strong local networks. He outlines the value of rural autonomy, community resilience, and coherent decision-making that reduces exposure to centralized grids. He encourages the movement of capital and attention toward local systems that strengthen sovereignty within the changing global architecture.

But What About The Jews?

Professor Jiang’s ontology presents world history as a sequence of long civilizational cycles driven by accumulated cultural memory, ritual resurgence, and symbolic triggers that surface when a civilization moves toward a terminal phase. He identifies specific players who activate these signals in the modern era.

These include priestly-lineage groups preparing for renewed sacrificial rites, organizations constructing ritual vessels for future Temple service, activists advancing Third Temple politics, and breeding programs dedicated to producing unblemished Red Heifers required for purification ceremonies.

Jiang treats these developments as leading indicators of a civilizational hinge point because they revive practices associated with foundational moments in Jewish history.

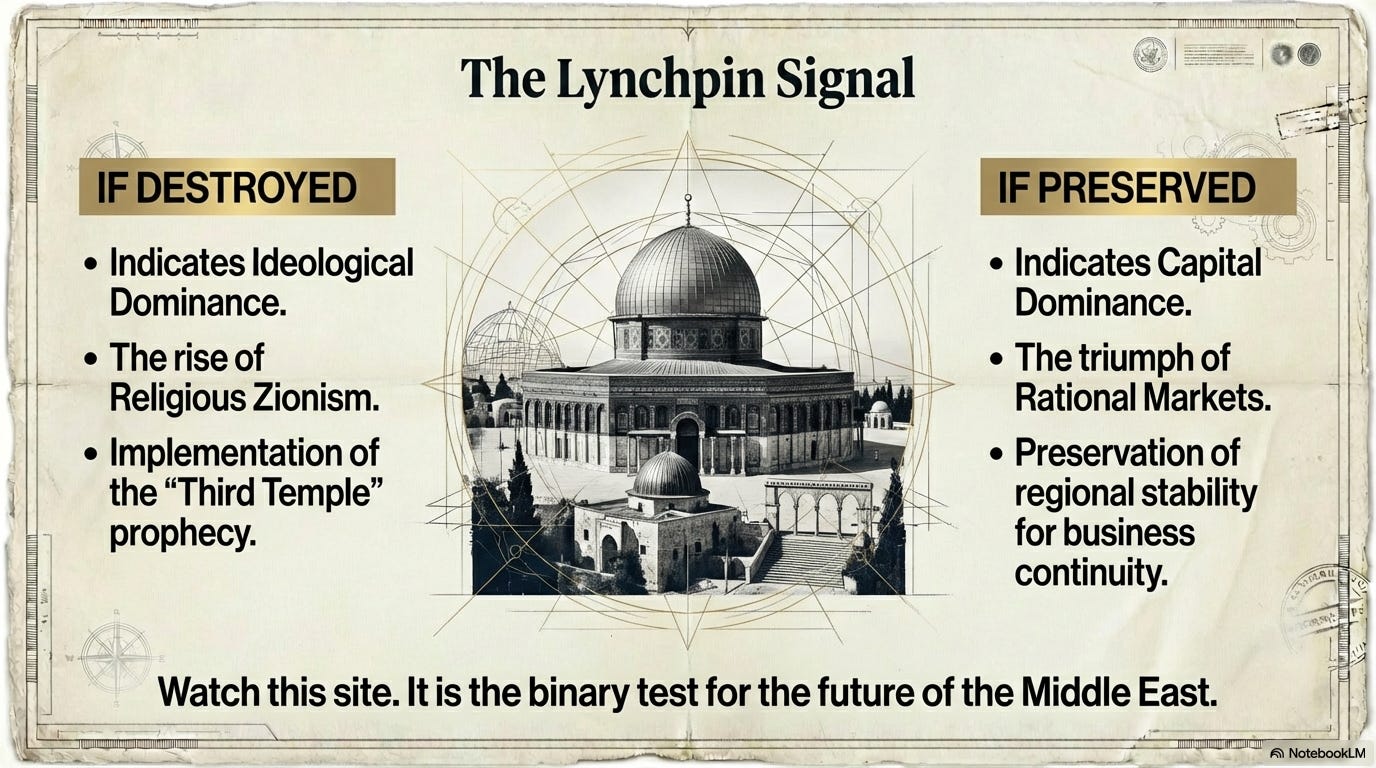

In his model, these signals accumulate until they converge on a decisive cultural rupture involving the Temple Mount and the legacy of the Second Temple. Jiang assigns central significance to this site: the destruction of the structure currently occupying that location becomes the definitive marker that the civilizational cycle has reached its crisis stage.

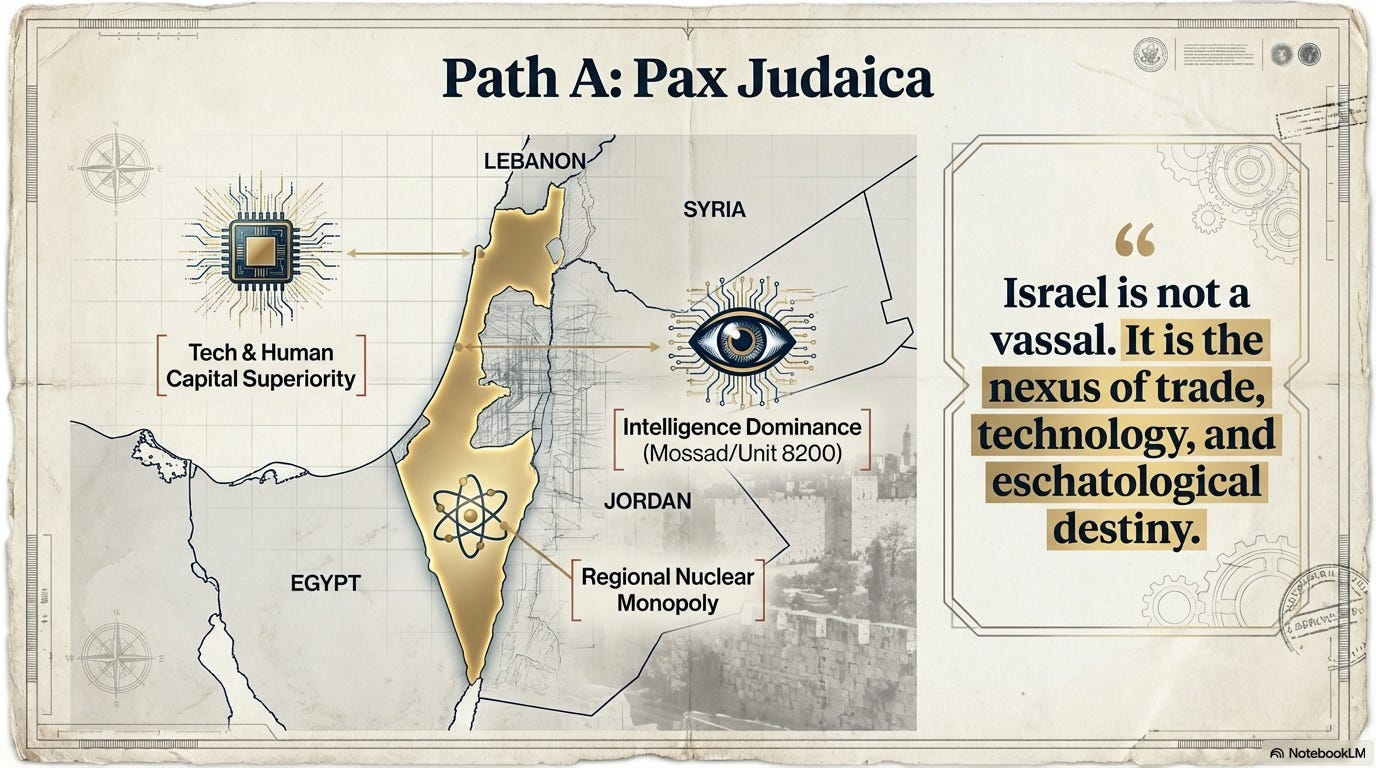

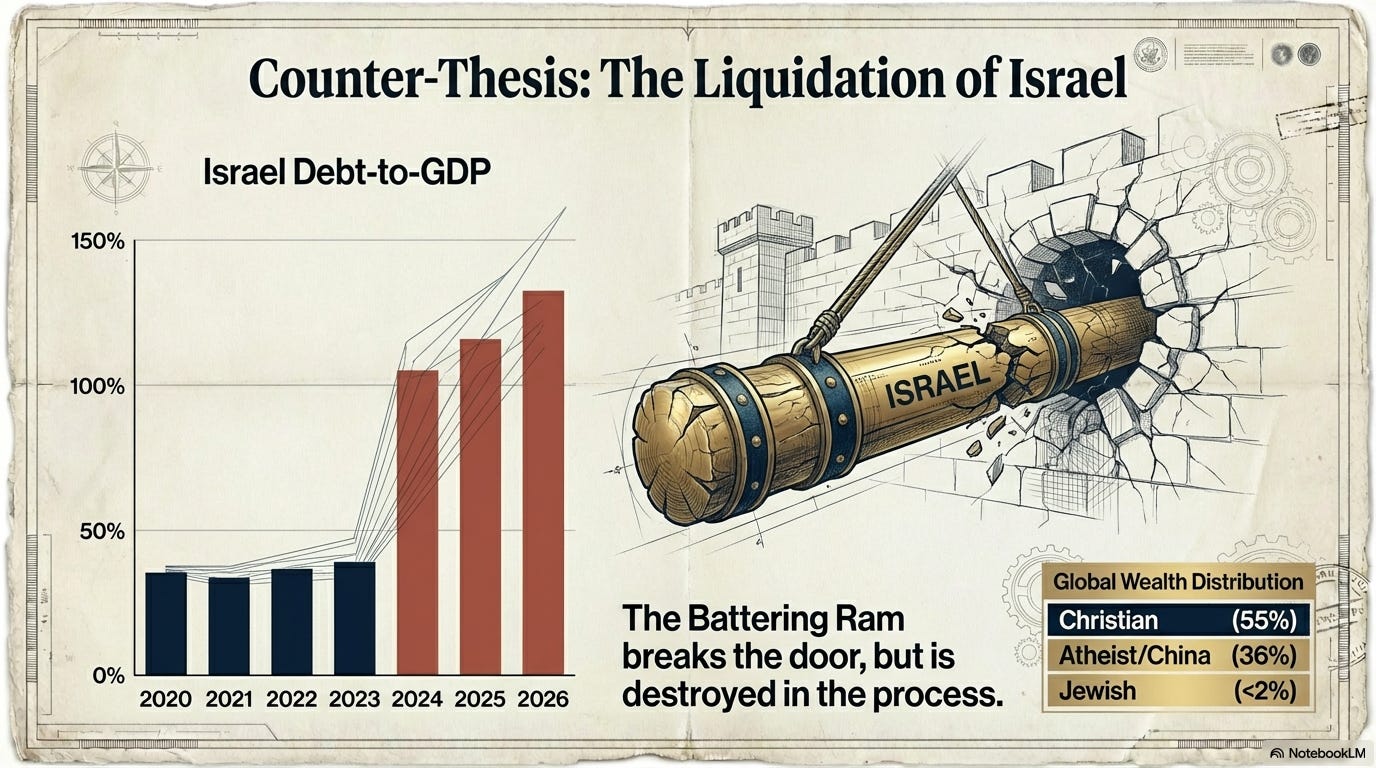

Dixon places his financial ontology alongside Jiang’s civilizational ontology and proposes a single test to distinguish them.

He views Jiang’s indicators — Red Heifer preparation, priestly mobilization, Third Temple advocacy, and intensified activity around the Temple Mount — as evidence that Jiang’s model identifies powerful symbolic forces that may be gathering toward a climactic event. Jiang’s framework anticipates a moment when the structure that stands on the former site of the Second Temple is destroyed, clearing the way for the Third Temple and signaling the arrival of a new civilizational phase.

Dixon’s model anticipates restraint instead. He argues that the Financial Industrial Complex seeks stability across the region because large capital allocations, Gulf partnerships, infrastructure negotiations, and asset strategies rely on predictable conditions. The destruction of the Dome of the Rock creates severe systemic instability with no financial advantage for the factions he describes.

The test follows directly from these commitments. If the Dome of the Rock remains standing on the former site of the Second Temple, the outcome supports Dixon’s claim that financial logic shapes decisions at the highest geopolitical levels. If the Dome of the Rock is destroyed, Jiang’s ontology gains confirmation because the act reflects a cultural and civilizational momentum that overrides coordinated financial interests. Dixon elevates this to a decisive empirical question: financial coordination preserves the Temple Mount, and civilizational forces propel it toward rupture. The fate of the site that once held the Second Temple becomes the proving ground for which ontology governs global power.

Thanks to the generosity of my readers, all my articles are available for free access. Independent journalism, however, requires time and investment. If you found value in this article or any others, please consider sharing or even becoming a paid subscriber, who benefits by joining the conversation in the comments. I want you to know that your support is always gratefully received and will never be forgotten. Please buy me a coffee or as many as you wish.

The Duke Report - Where to Start

My articles on SubStack are all free to read/listen to. If you load the Substack app on your phone, Substack will read the articles to you. (Convenient if you are driving).

Foundational Articles

Podcast (Audio & Video Content)

Palmerston’s Zoo Episode 01 - Solving the Paradox of Current World History (9 Episodes)

Oligarchic Control from the Renaissance to the Information Age

SoundCloud Book Podcasts

I’ve taken almost 200 foundational books for understanding how the world really works and posted them as audio podcasts on SoundCloud. If you load the app on your phone, you can listen to the AI robots discuss the books on your journeys across America.

Duke Report Books

Over 600 foundational books by journalists and academics that never made the New York Times Bestseller list, but somehow tell a history we never learned in school. LINK