Thanks to my readers' generosity, all my articles are free to access. Independent journalism, however, requires time and investment. If you found value in this article or any others, please consider sharing or even becoming a paid subscriber, who benefits by joining the conversation in the comments. I want you to know that your support is always gratefully received and will never be forgotten. Please buy me a coffee or as many as you wish.

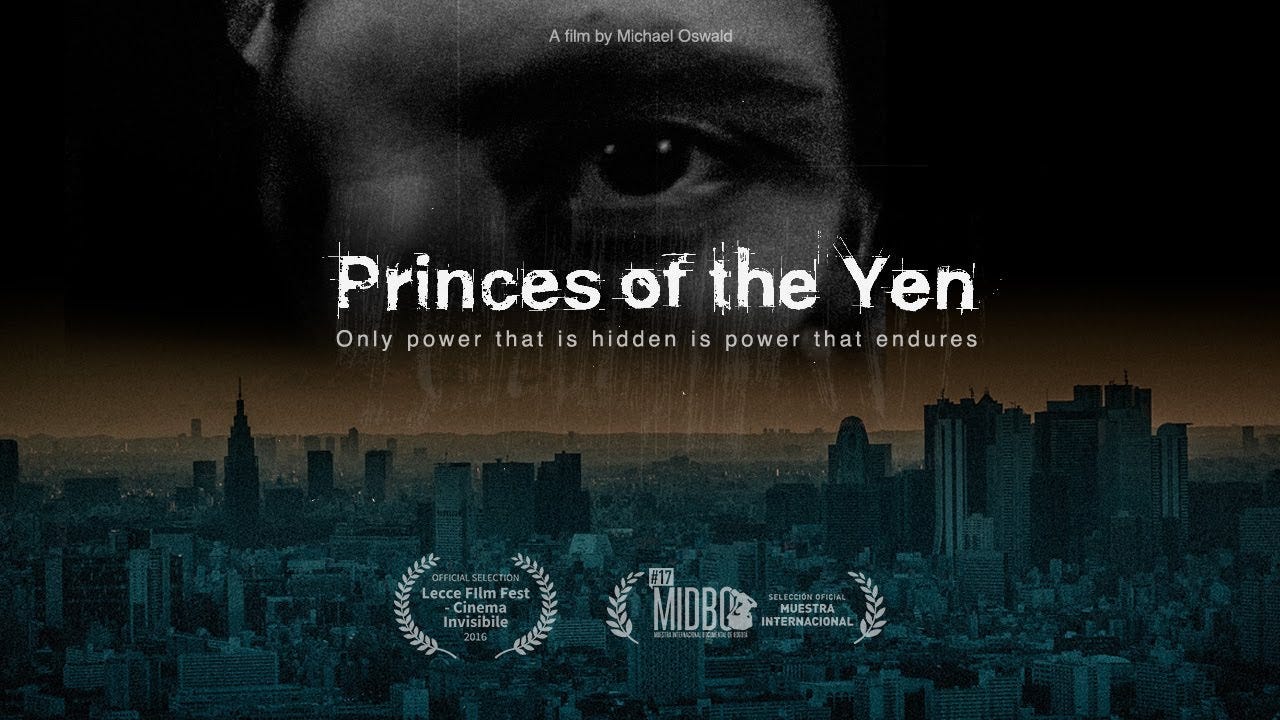

Princes of the Yen: Central Banks and the Transformation of the Economy

Michael Oswald’s film “Princes of the Yen: Central Banks and the Transformation of the Economy” 『円の支配者』reveals how Japanese society was transformed to suit the agenda and desire of powerful interest groups and how citizens were kept entirely in the dark about this. Based on the book of the same title by Professor Richard Werner, a visiting researcher at the Bank of Japan during the 90s crash, the film uncovers the real cause of this extraordinary period in recent Japanese history. The stock market dropped by 80% and house prices by up to 84%, significantly impacting the economy and society. The documentary critiques the central banking system’s role in manipulating economic conditions to enforce structural reforms, arguing that these actions primarily benefited elite groups at the expense of the general public.

Post-War Economic Policies and Central Bank Influence in Japan

Arrival of General Douglas MacArthur

On August 30, 1945, General Douglas MacArthur arrived in Japan, marking the beginning of a new era. His symbolic gesture of pausing at the top of the steps of his aircraft, with a corncob pipe in his mouth, was widely photographed and published, setting the tone for the American-led occupation. 02:36

Introduction of Democracy

Post-war Japan saw efforts to instill democracy among its people. These initiatives were part of a broader strategy to reshape Japanese society and its governance structure, a process closely monitored and controlled by the occupying forces. 03:16

War Crimes Tribunals

The war crimes tribunals held to prosecute Japanese military leaders, including General Tojo, were pivotal in reshaping Japan’s political landscape. These trials aimed to eliminate militaristic influences and establish a new order aligned with democratic principles. 04:05

Bank of Japan’s Post-War Actions

In the immediate post-war period, the Bank of Japan took significant measures to stabilize the economy. One of the key actions was purchasing bad loans from banks, effectively injecting new reserves into the banking system and preventing widespread financial collapse. 05:21

Structural Reforms and Economic Manipulation

Eikichi Araki’s Appointment and Indictment

Eikichi Araki was appointed as the first post-war governor of the Bank of Japan. However, his tenure was cut short when he was indicted by war crimes prosecutors, leading to his resignation. This incident highlighted the fragile political environment and the scrutiny faced by those in power. 06:04

US-Initiated Land Reform

To prevent rural unrest and support tenant farmers, the United States initiated land reforms in Japan. This redistribution of land aimed to weaken the power of large landowners and promote a more equitable agricultural sector. 07:20

Formation of the Liberal Democratic Party

In 1955, Kishi Nobusuke, a former war crimes suspect, became Prime Minister and established the Liberal Democratic Party (LDP). The LDP, supported by various funding sources, including crime syndicates, industrial corporations, and CIA slush funds, would dominate Japanese politics for decades. 09:08

Ministry of Finance’s Dominance

During the 1950s and 1960s, the Ministry of Finance exerted significant control over Japan’s economic policies. The ministry’s influence was so profound that its officials commanded deep respect and awe within the bureaucracy and the public. 11:19

Window Guidance Explained

The concept of “window guidance” was introduced by the Bank of Japan to control credit allocation. Under this system, the central bank dictated how much and where banks should lend, effectively steering the economy according to its policies. 12:44

Economic Growth and Competition

Japan experienced rapid economic growth during the post-war period. However, this growth led to “excess competition,” where companies competed fiercely for market share, often to the detriment of their financial health. 14:13

Banking Sector Cartels

Window guidance acted as a cartel-control mechanism within the banking sector. By dictating lending practices, the Bank of Japan prevented banks from competing excessively, maintaining stability within the financial system. 15:01

The 1980s Boom and the Bubble Economy

International Market Dominance

During the 1980s, Japanese corporations became dominant in international markets. This period saw significant growth and expansion, with Japanese companies leading in various industries worldwide. 16:07

Real Estate and Stock Market Boom

The aggressive lending policies of the 1980s led to a massive boom in real estate and stock markets. The rapid increase in asset prices created an economic bubble that appeared unsustainable. 24:17

Burst of the Bubble

In 1991, the economic bubble burst, leading to a severe downturn. The stock market plummeted, and real estate prices collapsed, resulting in significant economic and social consequences. 38:16

Abolishment of Window Guidance

The abolition of window guidance in 1991 marked a significant shift in Japan’s economic policies. Banks were left to operate without direct instructions from the central bank, leading to uncertainty and further economic challenges. 31:26

The 1990s Crisis and Structural Reforms

Economic Crisis and Bank Failures

The economic crisis of the early 1990s led to numerous bank failures and widespread job losses. The resulting social and economic instability highlighted the weaknesses in Japan’s financial system. 39:43

Bank of Japan’s Controversial Policies

The Bank of Japan’s controversial decision to restrict monetary easing aimed to enforce structural changes within the economy. This policy choice prolonged the recession and exacerbated economic hardships for many citizens. 47:53

IMF Intervention in Asian Crises

In the late 1990s, the IMF intervened in the Asian financial crises, enforcing significant political and economic restructuring in affected countries. These interventions often resulted in harsh economic conditions and social unrest. 1:15:28

Central Bank Independence

In 1998, Japan’s central bank gained independence from the Ministry of Finance. This shift aimed to prevent political interference in monetary policy but also raised concerns about accountability and transparency. 58:00

Koizumi’s Reforms and the Eurozone Comparison

Koizumi’s Reforms

Prime Minister Junichiro Koizumi, elected in 2001, implemented significant structural reforms. His policies, often compared to those of Margaret Thatcher and Ronald Reagan, aimed to transform Japan’s economy but also led to increased social inequality. 1:01:03

Eurozone Economic Issues

The documentary compares Japan’s economic issues to the financial problems faced by the Eurozone. Similar patterns of economic manipulation and enforced reforms are observed, suggesting a broader global trend. 1:22:53

Conclusion: The Hidden Power of Central Banks

Michael Oswald’s “Princes of the Yen” critiques the central banking system’s role in manipulating economic conditions to enforce structural reforms. The film argues that these actions primarily benefited elite groups at the expense of the general public, raising ethical concerns about transparency and accountability. By drawing parallels with global economic trends, the documentary highlights the profound and often detrimental impacts of central bank policies on societies worldwide. Ultimately, it questions the democratic accountability of these powerful institutions and calls for greater scrutiny of their actions. The documentary serves as a stark reminder of how financial power can be wielded behind closed doors, shaping economies and societies without public consent or knowledge. 1:29:00

FAQs

Central Bank Influence

What is the central theme of the documentary regarding central banks? The documentary focuses on the significant control central banks, particularly the Bank of Japan, have over national economies, often with limited oversight. 00:01:00

How do central banks influence economic outcomes? Central banks use various tools, such as interest rates and credit allocation policies like “window guidance,” to manipulate economic conditions. 00:12:01

Post-War Policies

What was the initial focus of Japan’s economic policies after WWII? Japan’s initial post-war policies aimed at economic stabilization through measures like buying bad debts with newly created reserves. 00:05:21

How did the policies shift over time? The Bank of Japan shifted strategies towards creating financial bubbles to enforce structural reforms and modernize the economy. 00:23:02

Window Guidance

What is “window guidance”? “Window guidance” is a system where the Bank of Japan directed banks on the amount and sectors to which they should lend, significantly influencing credit allocation. 00:12:44

How did this system impact the Japanese economy? The system allowed the Bank of Japan to control economic growth by dictating lending practices, which sometimes led to over-lending and economic bubbles. 00:13:10

Economic Bubbles

What caused the economic bubble in Japan during the 1980s? The economic bubble was caused by a massive credit boom, fueled by aggressive lending policies enforced by the Bank of Japan. 00:24:17

What were the consequences of the bubble bursting? The burst of the economic bubble led to a prolonged recession, massive job losses, and significant declines in asset prices. 00:38:16

Recession Management

How did the Bank of Japan handle the recession? The Bank of Japan was criticized for not printing more money to stimulate the economy, as it sought to enforce structural reforms instead. 00:47:53

What were the social impacts of the prolonged recession? The prolonged recession resulted in high unemployment rates, increased suicides, and widespread bankruptcies. 00:39:03

Independence of Banks

What is the documentary’s stance on the independence of central banks? The documentary questions the true independence of central banks, suggesting they often align with broader political and economic agendas. 00:52:00

Why is central bank independence controversial? Central bank independence is controversial because it can lead to a lack of accountability and transparency, affecting democratic governance. 01:28:11

Global Economic Patterns

How does the documentary relate Japan’s experience to global trends? The documentary shows similar strategies of economic manipulation and enforced reforms in other regions, such as the Asian Tiger economies and the Eurozone. 01:09:04

What are the implications of these patterns? These patterns suggest a recurring theme of using economic crises to implement structural reforms and change national economic policies. 01:17:12

IMF’s Role

What role does the IMF play in economic crises according to the documentary? The IMF often enforces significant political and economic restructuring in countries experiencing economic crises, sometimes exacerbating the situation. 01:15:02

How does the IMF’s involvement affect national sovereignty? The IMF’s policies can lead to a loss of national sovereignty as countries are required to adopt measures that favor foreign interests and liberalization. 01:19:23

Ethical Concerns

What ethical issues does the documentary raise? The documentary raises ethical concerns about using economic crises to manipulate public opinion and enforce structural reforms, questioning the transparency and accountability of such practices. 01:30:00

How does public manipulation impact societies? Manipulating public opinion through economic crises can lead to significant social and economic costs, including job losses, increased inequality, and social unrest. 01:31:12

Timeline of Important Events

August 30, 1945 General Douglas MacArthur arrives in Japan - General MacArthur’s arrival in Japan and his symbolic gesture. 00:02:36

Post-War Democracy instilled in Japan - The efforts to introduce democracy to Japan post-war are discussed. 00:03:16

Post-War War crimes tribunals - The trial and execution of Japanese war criminals, including General Tojo. 00:04:05

Post-War Bank of Japan’s post-war actions - The Bank of Japan’s measures to stabilize the economy by buying bad loans. 00:05:21

1945-1954 Eikichi Araki’s appointment and indictment - Eikichi Araki’s appointment as governor of the Bank of Japan and subsequent resignation due to war crimes charges. 00:06:04

1951 US land reform in Japan - The US-initiated land reform to prevent rural unrest and support the tenant farmers. 00:07:20

1955 Formation of the Liberal Democratic Party - Kishi Nobusuke, a former war crimes suspect, becomes Prime Minister and builds the Liberal Democratic Party with various sources of funding. 00:09:08

1950s-1960s Ministry of Finance’s power - The Ministry of Finance’s control over Japan’s economic life and the awe it inspired. 00:11:19

Post-War Window guidance explained - Introduction to the concept of window guidance and its impact on the banking sector. 00:12:44

1950s-1960s Economic growth and competition - Japan’s rapid economic growth and the emergence of “excess competition.” 00:14:13

Post-War Banking sector cartels - How window guidance acted as a cartel-control mechanism in the banking sector. 00:15:01

1980s International market dominance - Japanese corporations’ dominance in international markets during the 1980s. 00:16:07

1980s Real estate and stock market boom - The real estate and stock market boom fueled by aggressive lending policies. 00:24:17

1991 Burst of the bubble - The end of the bubble economy and the subsequent economic downturn. 00:38:16

1991 Abolishment of window guidance - The abolition of window guidance in 1991 and its impact on banks. 00:31:26

1990s Economic crisis and bank failures - The economic crisis of the early 1990s and the resulting bank failures and job losses. 00:39:43

1990s Bank of Japan’s controversial policies - The Bank of Japan’s controversial decision to restrict monetary easing to enforce structural changes. 00:47:53

Late 1990s IMF intervention in Asian crises - The IMF’s intervention in the Asian financial crises of the late 1990s and its impact. 01:15:28

1998 Central bank independence - The push for central bank independence and the changes to the Bank of Japan law in 1998. 00:58:00

2001 Koizumi’s reforms - Prime Minister Junichiro Koizumi’s structural reforms in the early 2000s and their social impacts. 01:01:03

2000s Eurozone economic issues - Comparison of Japan’s economic issues to the Eurozone’s financial problems. 01:22:53

2000s Critique of central bank practices - The documentary’s critique of central bank practices and their effects on global economies. 01:29:00